To avoid financial ruin in a divorce in Massachusetts:

- Understand marital assets and debts.

- Hire a reputable divorce attorney.

- Mediate to negotiate fair asset division.

- Create a realistic budget for post-divorce life.

- Avoid unnecessary litigation costs.

- Protect your credit score.

- Consider tax implications.

- Update your estate plan.

Understanding Divorce in Massachusetts

Starting Your Divorce Journey

Divorce is like hitting a reset button on your family life. It can feel scary, but knowing what to expect makes it easier. In Massachusetts, the divorce process is a set of steps that lead to your new life. You’ll hear words like “divorce case” and “court orders,” which are just fancy ways of saying “divorce journey” and “rules to follow.”

The Map to Success

Having an experienced divorce attorney by your side is like having a guide in an unfamiliar city. We know all the shortcuts and can keep you away from trouble. We’ll talk about things like “separate property” which is stuff you owned before you got married, and “marital property” like the family home or car that you both shared.

Money Matters:

Protecting Your Financial Future

Talking About Money

Talking about money might not be fun, but it’s key to not ending up with empty pockets. Whether it’s about the family home, retirement accounts, or even those joint accounts, you need to know what’s yours. And it’s not just about now, but also about your financial future. That’s where terms like “property division” and “financial statement” come in.

Divorce Settlements and Financial Security

A divorce settlement is when you and your former spouse agree on who gets what. It’s very important because it sets up your financial security after the divorce. It’s not just about who gets the most money or the biggest piece of real estate; it’s about making sure you can stand on your two feet when the divorce is over.

Kids Come First:

Child Support and Custody

Taking Care of the Most Valuable People

When you have kids, they are the most important players in the divorce game. Child support is the money one parent pays to the other to help with kid expenses, like clothes or school materials. The family court judge looks at many things to decide on child support, like how much money each parent makes.

Best Interests at Heart

Massachusetts law always wants what’s best for your kids. That’s why the court orders for child support look at what the kids need first. Sometimes, things like health insurance or special needs can change how much support there is. The idea is to make sure the kids feel like they’re still part of a team, even if the team looks a little different now.

Protecting Your Assets and

Legal Rights

Your Property and the Law

When you got married, you probably didn’t think about things like “who gets the retirement plan” or “what happens to the joint bank account if we split.” Now, you have to. An experienced family law attorney can be a big help. We know all about the legal system and we’ll make sure you keep what’s yours.

Divorce and Your Financial Information

During a divorce, you have to share a lot of financial information with the court and your divorce lawyer. This might include tax returns, mortgage payments, and even car titles. It’s like doing a big project at school where you have to show all your work. It can be tough, but it’s how the judge makes fair decisions.

Navigating Alimony and Spousal Support

in Massachusetts

Understanding Alimony/Spousal Support

Alimony, or spousal support, is money that one spouse might have to pay to the other after a divorce. It’s not in every divorce, but it’s there to make sure both people can live okay afterwards. If one spouse stayed home or earned less money, alimony helps them get by while they adjust to single life.

Fair Play with Money

Massachusetts law looks at things like how long you were married and how much money each person can make when deciding on alimony. It’s about being fair. Sometimes, people think it’s not needed, but it’s really about giving both people a chance to start fresh, especially if they’ve been out of work for a while.

Affordable Massachusetts Divorce Solutions

An affordable divorce is possible. At Afford Law, our fees are based on your income, so the less you earn, the less you pay. Our mission is to provide experienced legal help you can afford.

If you can’t afford our lower rates for a traditional attorney-client relationship, you have another option. Our legal coaching service can save you money and still give you access to a skilled attorney. In this arrangement, you represent yourself in court while we work with you behind the scenes to prepare you every step of the way. This service is available to you for one low monthly fee.

Dividing Everything Fairly:

Property Division

Splitting Things Up Right

When you split up in a divorce, you’ve got to split up your stuff too. The court looks at everything you both have, like real estate, retirement accounts, and even stock options. They try to divide it up in a way that’s fair, which is called “property division.”

Keeping It Honest

It’s very important to tell the truth about what you own and what you owe. If you hide stuff, like money in a separate bank account, you could get in big trouble. It’s like cheating on a test – it’s not worth it. Plus, having all your financial records ready shows the court you’re honest and makes things go smoother.

Dealing With Debt:

Joint Accounts and Loans

Shared Debts Can Be Tricky

Just like how you share your assets, you might share debts too, like a mortgage or credit card bills. Even if you’re getting a divorce, you still have to deal with these. It’s important to figure out who will pay what. We can help make sure you don’t end up with all the bills.

Clearing Up Money Owed

You don’t want to pay for stuff you didn’t buy, right? That’s why you need to sort out debts during the divorce. Sometimes, you can even get court orders to make sure both people pay their share. This way, you won’t have surprises later, and your credit score will thank you.

After Divorce:

Planning for the Long Run

Looking Ahead to Your Financial Future

Even when the divorce is done, there’s still work to do. Now, you’ve got to think about your long-term goals. Maybe you need to change the beneficiary on your pension plan or update your will. It’s like cleaning up after a party – not fun, but it has to be done.

Setting Up New Financial Habits

You might need to open separate bank accounts or get a new health insurance plan. It’s also a good idea to keep an eye on your credit report to make sure everything is okay. Think of it like starting a new chapter in your favorite book. It’s a fresh start.

Getting Help:

Financial Experts and Advisors

Money Experts Can Be Super Helpful

Sometimes you need a little extra help understanding your money, like how much you need to save for retirement or how to invest. Financial advisors and financial planners are like coaches for your money. They help you make smart choices so you can have a good life after divorce.

Finding the Right Advisor for You

Not all financial advisors are the same. You want to find one that gets you and what you need. It’s like picking a new game to play – you want one that’s fun but also makes you think. Your lawyer can often recommend a good financial advisor who has helped other clients in the same boat.

Wrapping Up:

The Bottom Line on Divorce

Divorce Doesn't Have to Ruin You

Divorce is tough, but it doesn’t have to ruin your life or your wallet. With the right help and a good plan, you can get through it. Remember, the best way to stay strong is to understand what’s happening and make the best choices for your future.

Staying Positive and Looking Forward

Even when things get tough, try to stay positive. Think about your future and all the good things to come. With a little help and a lot of heart, you can start a new life where you feel happy and safe. And that’s the best deal of all.

Legal Disclaimer

This article is intended for informational purposes only and does not constitute legal advice. Please consult with an attorney to discuss your specific circumstances and receive tailored guidance.

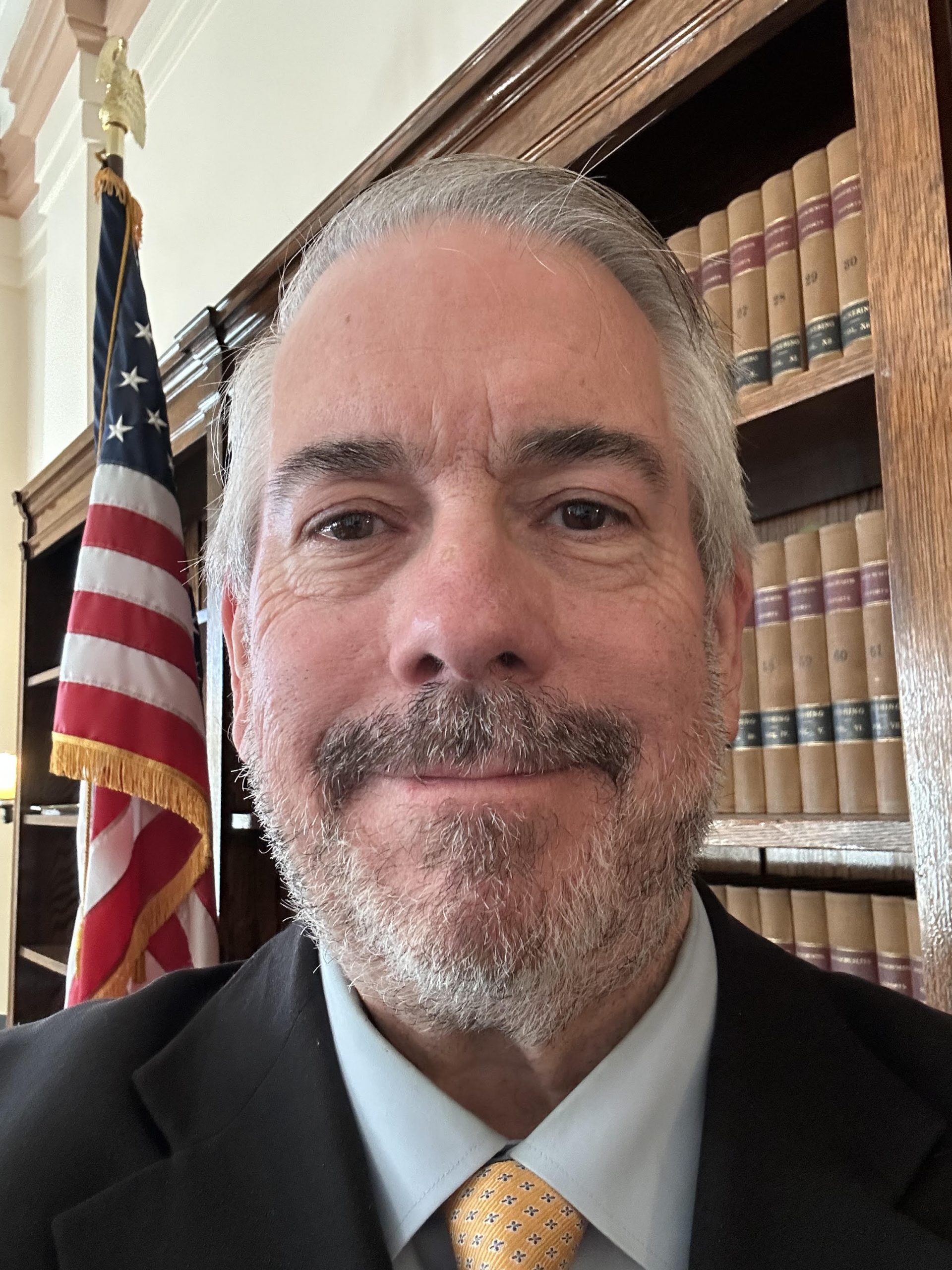

I have been practicing law in Massachusetts since 1995. My focus is in the areas of criminal and family law. I’m dedicated to providing high-quality legal help at an affordable price. I practice throughout Massachusetts. I earned my MBA from the University of Rhode Island in 2023. I earned my JD from New England School of Law in 1994. I earned my BA from Rhode Island College in 1990.